CCWO provides students real-world insight

COLUMBUS--Columbus High School seniors last Friday experienced Credit for Life--a real-world simulation aimed at revealing the struggles of budgeting and finances to high schoolers--annually sponsored by the Columbus Christian Women’s Organization.

Although Friday’s event was the main portion of the program, Credit for Life actually began at the beginning of February when representatives of the organization came to Columbus high school and provided the introduction of this simulation for students.

Students were told to imagine they were 25 years of age and just completed their post-secondary education.

Students were told to select the occupation they planned on pursuing in real life. These jobs range from medical practitioner to elementary school teacher to plumber, each with different ranges of income based on real-world information.

In February, students were also administered a 12-question quiz that would determine the students’ credit scores for the in-person simulation.

When Friday arrived, it was time to allocate each student’s monthly budget.

Students had to decide how much of their monthly income to spend on various expenses such as food, vehicles, insurance of various kinds, entertainment--including cell phone, internet, cable, hunting and fishing licenses, and gym membership--housing, and furniture, to name a few.

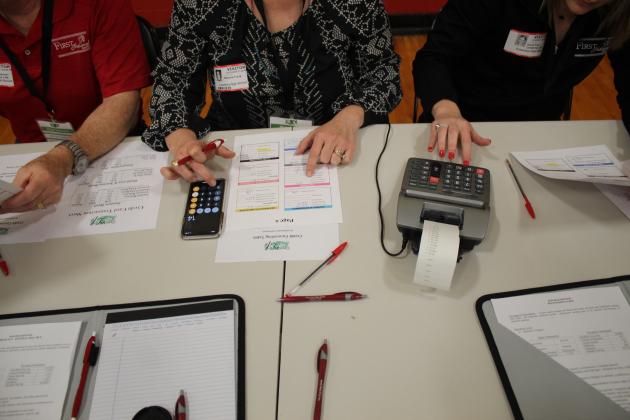

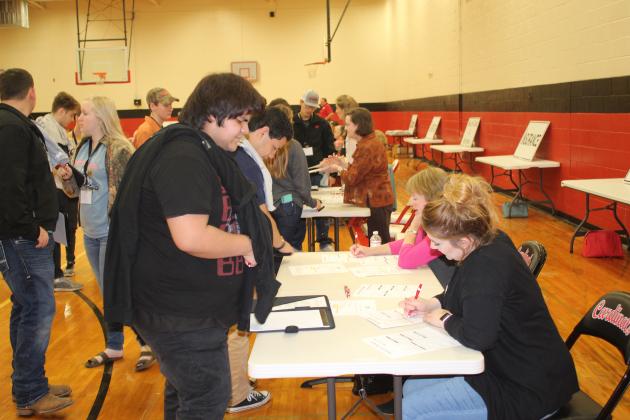

Students arranged for their housing, entertainment, and other expenses by visiting various booths run by volunteers from various businesses.

Students were required to visit each booth, and spend some of their imaginary budget at each booth.

There was also a “wheel of misfortune,” which all students also had to visit, and which would provide a random event which would either add some money or subtract money to the students’ working budgets.

It became clear very quickly to many students that lavish lifestyles would not be possible without the use of a credit card.

This was the portion of the exercise where one’s credit score would allow them to get a credit card with increasingly higher ranges of maximum credit limit.

The after-affects of the credit card were not explained up front, but instead the benefits of owning a credit card such as a greater spending power, were provided.

When it came time for students to see if their budgets were in the “red,” or the “black,” after all booths had been visited, the added interest of the credit card was added to the total amount spent, which was then subtracted from each student’s monthly allowance. Most students who didn’t select a six-figure job came out in the red and had to make adjustments.

Overall, students learned valuable lessons from the exercise including the importance of credit, the importance of wise spending, and the importance of budgeting.